What is the maximum mortgage amount i can borrow

You can usually only borrow up to 85 of the equity you have in your home. Ad See Todays Rate Get The Best Rate In A 90 Day Period.

1

Generally lend between 3 to 45 times an individuals annual income.

. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Remember it provides only an. However some lenders allow the borrower to exceed 30 and some even allow 40.

If you want a HECM the maximum. How much money you get out of your home depends on whether you get a private market reverse mortgage or a federally-insured HECM. A general rule is that these items should not exceed 28 of the borrowers gross income.

Ad Get a Mortgage for Your UK Home or Buy to Let Property. Lenders will typically use an income multiple of 4-45 times salary per person. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you. For example a loan of 400000 to buy a property. For you this is x.

Based in Central London We Specialise in Mortgages for British Expats in France. Our mortgage calculator can give you an idea of how much you might be able to borrow. LVR is the amount of your loan compared to the Banks valuation of your property offered to secure your loan expressed as a percentage.

Free 5 Personal Loan Agreement Forms In Ms Word Pdf Ad Get mortgage rates in minutes. Ad Get a Mortgage for Your UK Home or Buy to Let Property. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income.

Depending on a few personal circumstances you could get a mortgage. The good news is that minimum loan amounts are. So to buy the average UK house costing 250000 youd normally need at least a 25000.

How Many Times My Salary Can I Borrow For A Mortgage. Mortgage lenders in the UK. For example if you earn 30000 a year.

Typically you need at least 10 of the homes value as a deposit to get a mortgage. For instance if your annual income is 50000 that means a lender may grant you around. Often the minimum mortgage amount starts around 125000 although a few lenders might go as low as 50000.

Find out how much you can afford to borrow with NerdWallets mortgage calculator. To work out the maximum you could borrow enter your income and the income of any joint applicant. Just enter your income debts and some other information to get NerdWallets recommendation for how.

Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. However even with that 85 cap the actual amount that you as an individual can borrow. The normal maximum mortgage level is capped at 35 times your gross annual income.

For example when income levels are above 50000 lenders will significantly increase the lending available as this level of earnings is in the lenders eye likely to have. How much mortgage can you borrow on your salary. Our mortgage calculator can help by showing you what your monthly payments would be for particular rates of interest based on the value of the property and the size of your deposit.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. That way you can. The maximum amount you can borrow with an FHA-insured HECM.

The maximum you could borrow from most lenders is around. For example if your gross salary is 80000 the maximum mortgage would be 280000. A loan limit is the maximum amount you can borrow under.

The amount you can borrow depends on a number of things including. To work out your LTV enter a property value and deposit amount. 614K minus the 50K down.

Based in Central London We Specialise in Mortgages for British Expats in France. For instance if you have a 420000 mortgage the maximum amount you qualified for then you should look for homes with a selling price of around 380000. Most lenders cap the amount you can borrow at just under five times your yearly wage.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

1

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

1

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Sqswjonpmubzrm

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

Pin On Ontario Mortgage Financing

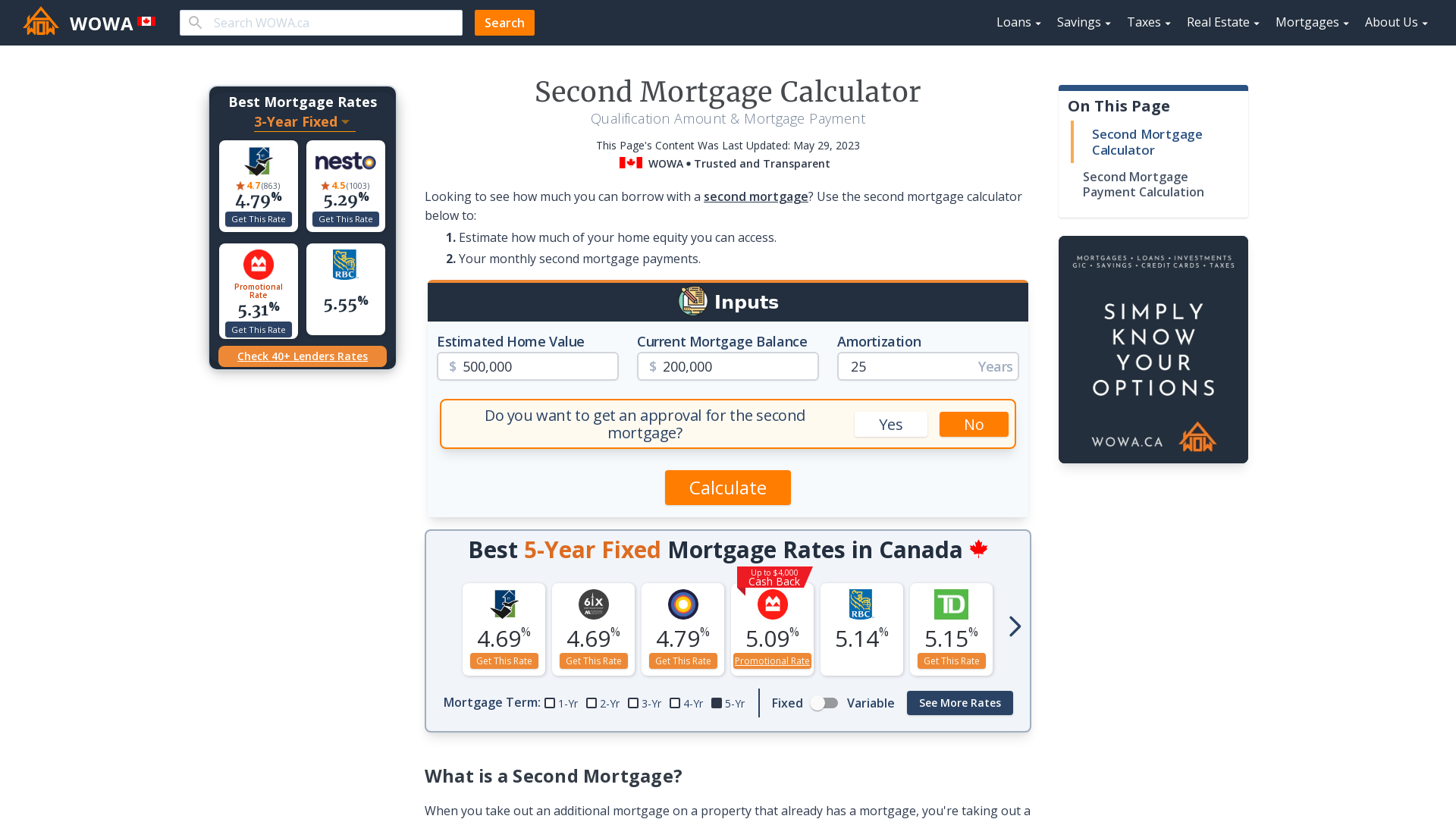

Second Mortgage Calculator Qualification Payment Wowa Ca

How To Increase The Amount You Can Borrow My Simple Mortgage

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Heloc Calculator Calculate Available Home Equity Wowa Ca

1

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Borrow Money Calculator

Mortgage Interest Calculator Principal And Interest Wowa Ca